When people hear the term “LS 그룹 재무 연결 20214,” the first question that often pops up is, “What exactly does this mean?”

This can sound complex, but it’s actually a lot more straightforward than you’d think.

Financial consolidation, or “재무 연결,” essentially means pulling all the financial reports and figures from different branches or businesses under one group.

For LS Group, a large conglomerate in South Korea, this is crucial to making sure everything runs smoothly.

Why Is LS 그룹 재무 연결 20214 Important?

You might be wondering, why should anyone care about LS 그룹 재무 연결 20214?

Well, it’s about more than just numbers on a spreadsheet.

Financial consolidation allows companies like LS Group to get a clear view of their financial health.

It’s like taking all the ingredients from different kitchens and combining them to create one meal.

You get the complete picture, rather than just seeing bits and pieces.

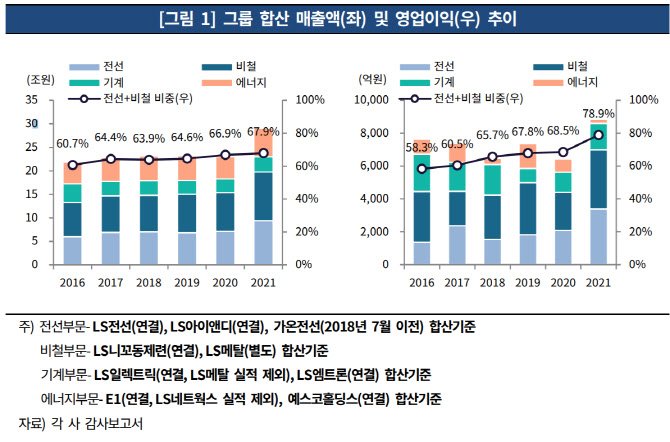

For LS Group, this means tracking how their various sectors—such as energy, infrastructure, and IT—are performing financially.

By doing this, they can make smarter decisions about where to invest and where to pull back.

How Does Financial Consolidation Work?

Now, let’s break it down a bit more.

When LS Group carries out 재무 연결, they gather all the income statements, balance sheets, and cash flow reports from their different subsidiaries.

Then, they merge this data into one cohesive report.

Imagine LS Group has multiple companies under its belt, each doing its own thing.

One might be dealing with power cables, another with batteries, and yet another with IT solutions.

Each of these companies creates its own financial reports, but at the end of the day, LS Group needs to see how the entire group is doing as a whole.

That’s where financial consolidation comes in—it’s the method they use to get that big picture.

Key Benefits of LS 그룹 재무 연결 20214

Now, let’s talk benefits.

Why does LS Group (or any large company) bother with financial consolidation?

It’s not just for show—there are some real advantages:

- Clarity: Financial consolidation gives a complete view of the group’s financial health.

- Efficiency: Instead of managing multiple reports, LS Group can streamline their processes with one unified report.

- Strategic Decision-Making: With a full financial picture, LS Group can make informed decisions, whether that’s expanding a successful part of the business or cutting back in areas that are underperforming.

How Does LS 그룹 Keep It All Together?

Handling the financials for a large group like LS isn’t a small task.

It involves a lot of moving parts.

But they make it work by using advanced financial management tools and software that automate much of the consolidation process.

These tools ensure that data from all subsidiaries is accurate and up-to-date.

Imagine trying to handle all of that manually—it would be a nightmare!

The keyword here is automation.

With technology, LS Group can pull together data from various businesses in real time.

This means faster reports, quicker insights, and better decisions.

Real-Life Example: Why Financial Consolidation Matters

Let’s look at a real-life example.

Picture a scenario where one part of LS Group is thriving—say, their energy division—but another part, like their IT division, is struggling.

Without financial consolidation, LS Group would only see individual reports.

They might think everything is going fine, based on the strong performance of the energy division.

But with 재무 연결, they get the full story.

They can see that while energy is doing well, the IT division needs attention, allowing them to allocate resources more effectively.

This holistic view helps LS Group ensure they’re putting their money and efforts in the right places.

FAQs about LS 그룹 재무 연결 20214

Q: What is LS 그룹 재무 연결 20214?

A: This refers to LS Group’s process of consolidating financial reports across its various business units to get a clear, unified view of its overall financial health.

Q: Why is financial consolidation important?

A: It helps large companies like LS Group make better decisions by providing a comprehensive overview of all their financial data.

Q: How does LS Group handle financial consolidation?

A: LS Group uses advanced financial software to automate the consolidation process, ensuring accurate and up-to-date financial reports.

Q: Can small businesses benefit from financial consolidation?

A: Absolutely.

Even smaller companies can use consolidation techniques to get a clearer picture of their financial standing if they have multiple branches or subsidiaries.

Q: How often does LS Group perform 재무 연결?

A: Typically, large companies like LS Group will consolidate their financials quarterly or annually, depending on reporting needs.

Conclusion: Why LS 그룹 재무 연결 20214 Is Key to Success

At the end of the day, LS 그룹 재무 연결 20214 isn’t just a bunch of numbers.

It’s the foundation for smart business decisions.

For LS Group, this process ensures they always know how their different businesses are performing.

By consolidating their financials, they can focus on growth, make data-driven decisions, and stay ahead of the competition.

This process might sound technical, but it’s really about clarity and strategy.

Without 재무 연결, LS Group would be flying blind.

With it, they have a clear roadmap for the future.

So, when you hear the term “LS 그룹 재무 연결 20214” again, you’ll know it’s more than just accounting.